Launch of Catalytic Impact Loan Fund in Western Australia

Launch of WA Impact Loan Fund

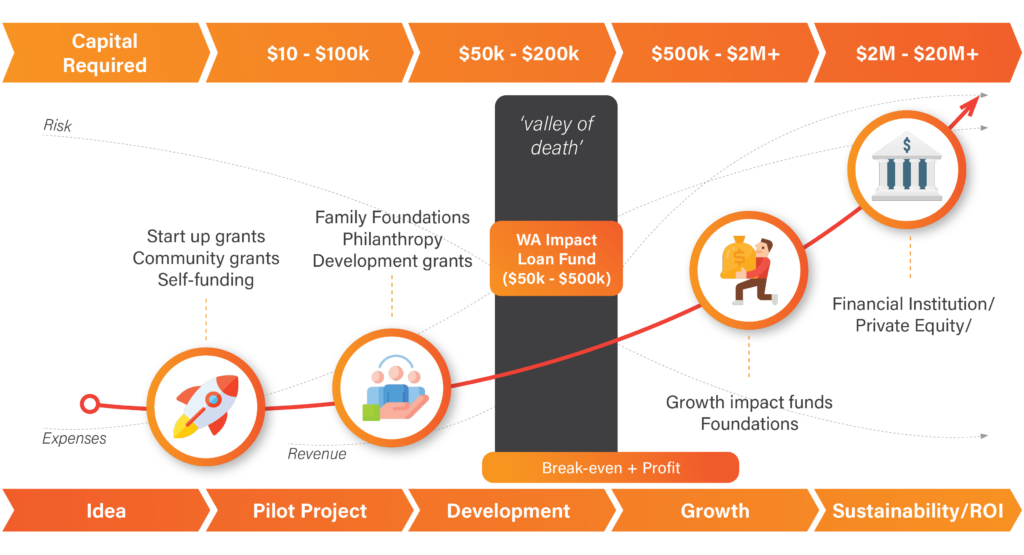

The Challenge

There has long been a gap in the WA impact investment market between grant funds and risk-adjusted return capital – the valley of death – where impact-first social enterprises struggle to access capital to grow.

Our Response

2024 sees the launch of the Impact Seed’s WA Impact Loan Fund which is targeting deployment of $2M in catalytic impact capital in WA in the next two years through a co-investment approach. This is the first fund in WA to take a collaborative approach to delivering patient, concessionary, and fit for purpose finance between $50-$500K to social enterprises at the crucial Development stage* of their growth.

The new WA Impact Loan Fund is patient in nature, concessionary in terms, and fit for purpose finance structures and due diligence support for deals between $50-$500K. The Fund is underscored by Impact Seed’s long history and knowledge of the WA social enterprise and impact investment markets.

For Social Enterprises

The Offer

- Patient debt capital (3-7+ year repayment terms)

- Concessionary terms including below market rate interest and deferred repayment options

- Loan sizes of $50-500k on a co-investment basis

The Criteria

- Enterprise must be at Development stage*

- Delivering social, cultural and environmental impact grounded in WA

- Committed and capable leadership

- High social impact in the area of breaking cycles of disadvantage (eg job creation, health, education). We warmly welcome Aboriginal enterprises through our EOI process.

For Investors

We invite Grant-making foundations, funds and family offices to co-invest alongside the WA Impact Loan Fund and access Impact Seed’s pipeline and resources including due diligence, investment process and reporting. Your capital will help unlock the Fund capital so we can catalyse the WA impact investment market together.

Prospective impact funders (govt, grant-making foundations impact investors) are also invited to the private Investor Series events to learn more about blended finance, and Impact Seed’s WA Impact Loan Fund.

Key Enabling Partners

Australians are developing an ever-broadening understanding of impact investing and ESGi.

We want to know our resources are working towards a better future for ourselves, for future generations and for the broader society in which we live.

Impact investment and social enterprise are amongst the fastest growing industry sectors in the world. Impact investment is an estimated $1Trillion global market growing at a high double-digit CAGR as the world comes to grips with climate, pandemic and inequality crises and the need for systems change in the worlds of finance and entrepreneurship.

At Impact Seed, we link investors and funds to opportunities that make a difference, and build the market of investment opportunities with deep-impact at the fulcrum point. Our services include:

- Supporting granting foundations and investors on their journey to impact through capacity building support.

- Origination and deal sourcing for impact investors,

- Investment pathways for enterprises and ventures

- Impact investment management.

WA Impact Fund # 1

UPDATE NOV 2021: WA IMPACT FUND #1 IS FULLY COMMITTED

Australia’s first place-based impact investment fund creating impact in WA was launched in 2020 with $20M anchored by WA Super. WAIF was a superannuation backed investment fund co- managed by Impact Seed alongside Impact Investment Group.

Impact Seed is currently working towards addressing the ‘missing middle’ of impact investment through a catalytic fund.

We connect investors and enterprises with a deep impact focus

Origination and deal sourcing for impact investors

Impact Seed is WA’s only social enterprise and impact investment deal-focused intermediary – aiming to support investment pathways for impact enterprises and ventures.

Assisting impact businesses with raising capital

Impact Seed can support social enterprises and for-purpose businesses in sourcing impact investment to scale their business.

Impact investment management

We can provide support and guidance on behalf of impact investors to social entrepreneurs and impact investments post- investment.