Journey to Impact - Why Catalytic Investment?

Journey to Impact – Why Catalytic Investment?

By Alexandra Humphry

21 April 2024

This is the first in Impact Seed’s ‘Journey to Impact’ series of articles focusing the growing impact investment and social enterprise landscape in Western Australia.

Background

For the past 10 years Impact Seed has worked to bridge the divide between social enterprises and impact investors in Western Australia. In this time, access to catalytic investment has remained a stubborn bottleneck in the ecosystem, with 80% of WA’s impact entrepreneurs reporting early-stage investment as their barrier to survival and growth (Social Enterprise Mapping Project 2023). At the same time, access to investment-ready enterprises is reported as the key barrier for investors.

Impact Seed has worked predominantly on capacity building for both social enterprises and impact investors at this nexus, through programs like Impact 2 Innovate. As we now set out on the path of deploying $2m of catalytic co-investment capital over the next 2 years through the WA Impact Loan Fund, we are diving deep on what catalytic investment means for both potential co-investors and investees and ways we can bridge this divide, and scale impact in WA.

What is Catalytic Investment?

Catalytic investment has the potential to unlock and accelerate innovative and effective solutions to social and environmental problems by giving enterprises more time and space to develop the solution/business model and crowd in a range of co-investors across a broad spectrum of risk/return/impact profiles.

“Catalytic investment is defined as capital

(debt, equity or other investments) that accepts

disproportionate risk and/or concessionary returns

to generate positive impact and enable third party

investment that would likely not be possible otherwise”

[1].

Catalytic investment is crucial in the efforts to tackle the enormous challenges the world faces. Its flexibility and ability to go where others cannot helps to unlock innovative solutions, build track record and attract future investors[2].

Forms of catalytic investment

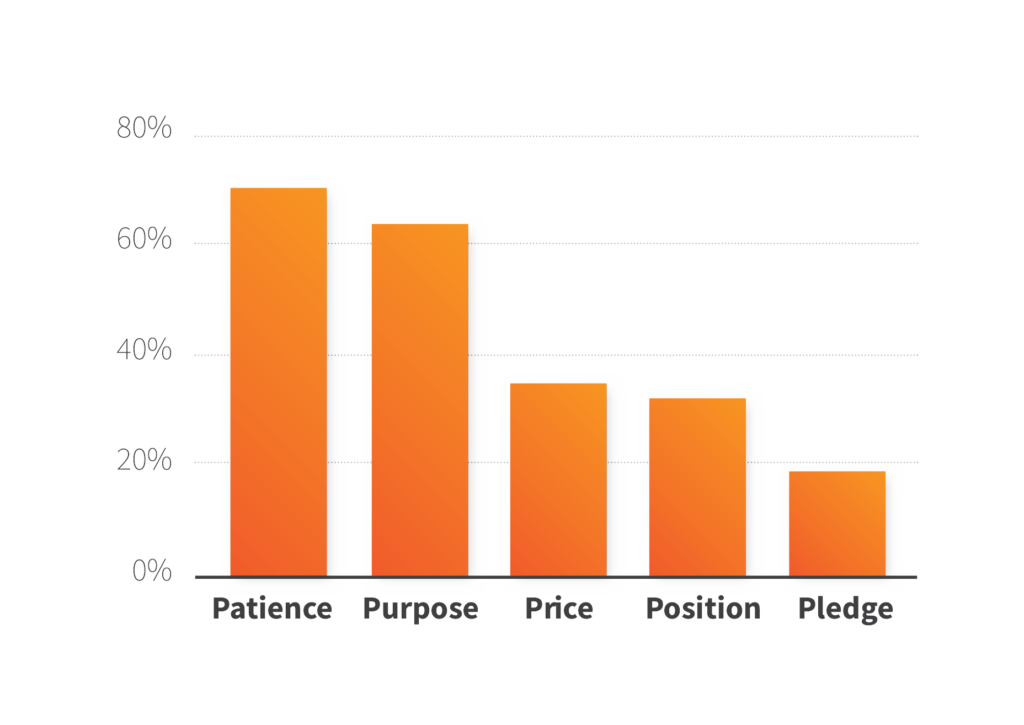

Catalytic investment can come in a number of forms and dimensions. Over the past decade these forms have been summarised as the five P’s of catalytic investment[3]:

Research last year by the Impact Finance Research Consortium1 collected data from 216 impact investing fund managers from around the globe and found ‘Patience’ is the most commonly deployed form of catalytic investment (70% of fund managers). The research also found that the majority of fund managers had a multi-faceted strategy that meant they used multiple forms (or P’s) of catalytic capital at once. The following chart shows the results of the survey:

Figure 1: Representation of catalytic investment forms

Reasons for deploying catalytic investment capital

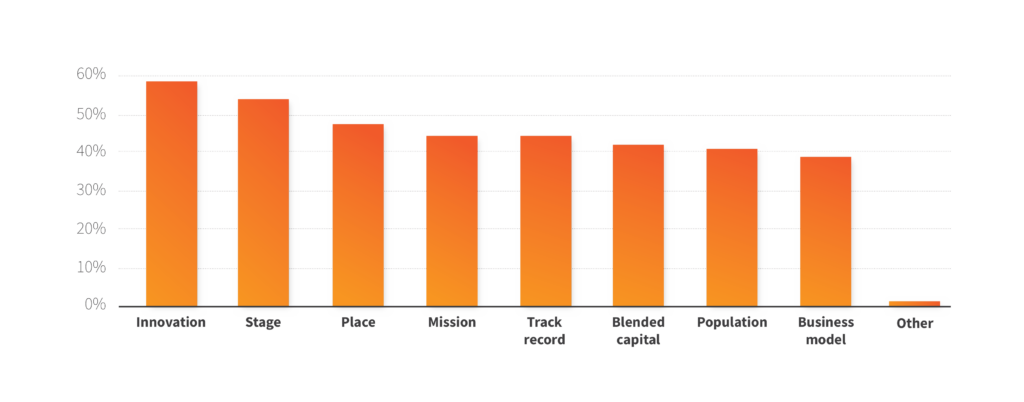

The same research explored the reasons fund managers deploy catalytic investment capital which included:

‘Innovation’ (59%) and ‘Stage’ (54%) were the two leading responses. The following chart shows the results of the survey:

Figure 2: Representation of reasons for deploying investment capital.

What about some WA examples?

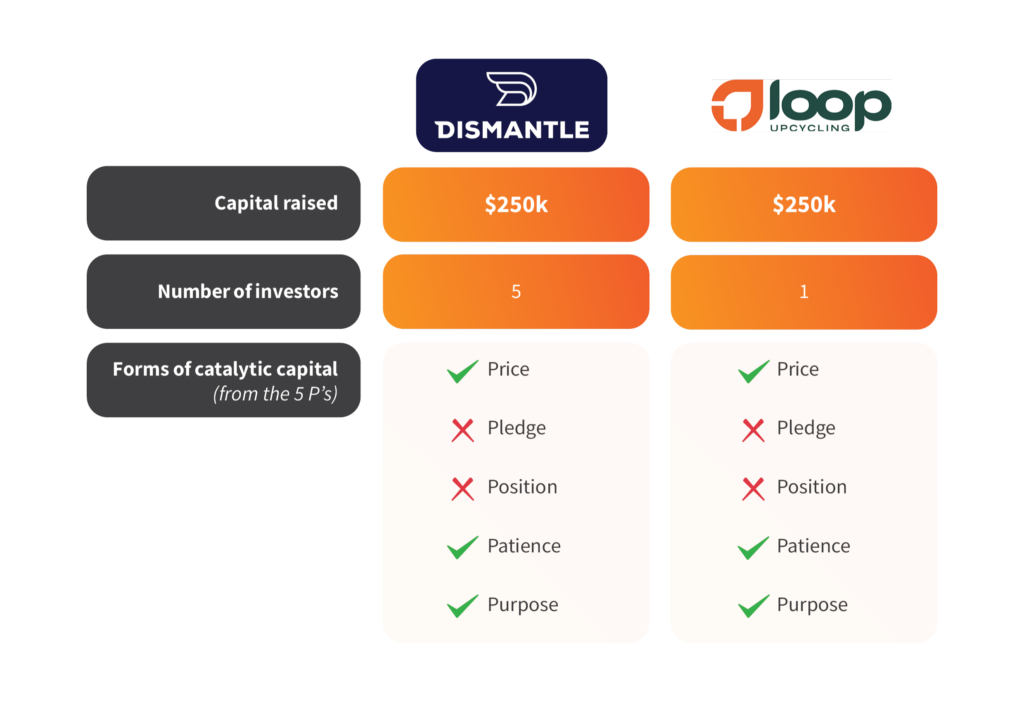

In 2023 there were two catalytic capital investments of note in WA – debt instruments raised by Dismantle and Loop.

In these two examples, there was alignment with the global survey on forms of catalytic investment and reflects the study’s finding that investors generally draw on multiple forms of catalytic investment as part of a multifaceted strategy to achieve positive impact.

We surveyed the investors across both of these transactions and whilst there was a range of reasons for deploying their capital in this way, there were some common threads:

- Innovation – to derisk and promote both the business models and financial products used (catalytic impact investing).

- Track record – this was also in two dimensions and linked to innovation. A desire to demonstrate a social enterprise business model can work as well as an impact investment product.

- Stage – acknowledgement of the challenge to raise capital at this stage that isn’t prohibitively expensive

There was also a strong theme amongst investors of an additional purpose around impact alignment. Several noted one of the key reasons for deploying the capital was to further the impact of the organisation. This may be a reflection on the type of investors amongst this group that includes mainly family foundations and a not-for-profit, all with a very strong focus on deep impact.

One investor said “The overarching reason is to enable them [social enterprises] to have funds at a reasonable rate to achieve their aims. As an investor it also means you get some return (even though not market rate), but the money will presumably be repaid and so you can offer more funds than if you just made a donation.”

WA Impact Loan Fund

Impact Seed’s recently launched WA Impact Loan Fund aligns with 3 of the forms (or P’s) of catalytic capital: ‘Price’, ‘Patience’ and ‘Purpose’. Through this fund we will be deploying patient, low-interest loans to social enterprises of $50-$300k. Our primary reasons for bringing this catalytic capital to the market are:

- Innovation – supporting the acceleration of social impact in WA

- Track record – developing the social enterprise market in WA by supporting the growth of enterprises, in anticipation of future investment and growth

- Building the catalytic capital market in WA – by crowding in and building investor confidence in these sorts of structures and opportunities with the ability to derisk through sharing due diligence and taking a cornerstone investment

Investors

We are looking for co-investors into each of impact loans that we undertake through the WA Impact Fund, and we welcome anyone who is interested in deploying catalytic capital for impact in WA to get in touch.

Social Enterprises

If your a social enterprise looking for support to scale your impact in Western Australia, the Impact 2 Innovate social enterprise growth program is open for EOIs until Friday 26th April.

[1] Brown, M., Kadam, R., Klein, K., 2023, Impact Finance Research Consortium, Catalytic Capital in Impact Investing – Forms, Features and Functions, accessed at: https://www.convergence.finance/resource/catalytic-capital-in-impact-investing-forms-features-and-functions/view on 25 Feb 2024

[2] Koy, H., 2024, Stanford Social Innovation Review, 5 Myths Preventing Catalytic Capital From Going Where It’s Needed, accessed at: https://ssir.org/articles/entry/impact-investing-catalytic-capital-myths on 29 Feb 2024.

[3] Brest, P., Born, K., 2013, When can impact investing create real impact, accessed at: https://ssir.org/up_for_debate/article/impact_investing on 29 Feb 2024

<Back to News & Updates

Please follow us on Linkedin to stay up to date on latest news and articles.